Recent Articles on Ads and Video games

October 2008

Advertising Strategists Target Video Games

![]()

April 21, 2006 10:33AM ![]()

Visa isn’t the only brand getting into the virtual action. In-game advertising is expected to double to nearly $350 million by next year, and hit well over $700 million by 2010, according to a report released this week by research firm the Yankee Group.

Advertisers are getting into the game — the video game. Increasingly, big-name marketers are turning to game developers to woo consumers more interested in the game controller than the remote control.

“The fact is you aren’t able to reach consumers the same way you could 20 years ago, 10 years ago or maybe even five years ago,” said Jon Raj, vice president of advertising and emerging media platform for Visa USA.

Visa ingrained itself into Ubisoft’s PC title “CSI 3” by making the credit card company’s identity theft protection part of the game’s plot. “We didn’t just want to throw our billboard or put our Visa logo out there,” Raj said.

Visa isn’t the only brand getting into the virtual action. In-game advertising is expected to double to nearly $350 million by next year, and hit well over $700 million by 2010, according to a report released this week by research firm the Yankee Group.

Bay State game creators are already reporting an uptick in interest from marketers wanting to roll real-life ads into fantasy worlds.

“I’ve seen increased interest here and throughout the industry,” said Joe Brisbois, vice president of business development for Cambridge-based Harmonix Music Systems. Harmonix’s last offering “Guitar Hero” featured a variety of Gibson guitars.

“People don’t know how this is all going to pan out yet,” Brisbois said, adding the market will likely boom once customers can buy products without turning off the game. “Once people are able to jump from a game to a retail space online and back, that will be a powerful motivator,” he said.

With more ad dollars pouring into the industry some smaller players are hopeful they’ll see some of the cash.

Even smaller developers producing addictive games will share in the wealth, said Michael Gesner, president of Dragonfly Game Design in Westboro.

Companies crafting cell phone games are also expected to see a boom in marketing revenue. Spikes in advertising through online, console and PC games will translate into the mobile world as well, said Matthew Bellows, general manager and vice president of Floodgate Entertainment, which makes games for mobile phones.

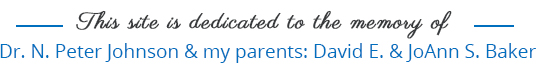

(Screen shot from MLB 2K6, showing real ads embedded in virtual game)

Baseball video game gets in-game ads

By Scott Hillis Thu Apr 6, 9:17 AM ET

SAN FRANCISCO – For some baseball video game fans, a trip to the virtual ballpark is getting a bit more realistic — for better or for worse — with the arrival of in-game advertising.

Massive Inc. said on Wednesday that Take-Two Interactive Software Inc. is using its ad-delivery system to put billboards, logos and other corporate promotions in the game “Major League Baseball 2K6.”

The deal, which also involved Major League Baseball and the Players‘ Association that controls athletes‘ images, is a big boost for Massive, which hopes to tap the growing popularity of a medium whose annual revenue of $25 billion is now bigger than Hollywood‘s box office haul.

“Video games are front and center as a major new advertising medium,” Massive chief executive Mitch Davis told Reuters in an interview.

Advertisers are expected to spend up to $100 million this year on such ads, and Davis said that could swell to $3 billion in 2010 as ad money chases the coveted demographic of 18 to 34-year-old men, who are increasingly turning to games as their primary form of entertainment.

Davis did not disclose the size of the Take-Two deal except to say that it was several million dollars that will be split between Massive, the publisher, MLB, and the players.

Video game makers are attracted to in-game ads because they can help offset soaring development costs. Some gamers, however, chafe at the idea of being exposed to ads in a product that costs as much as $60.

Massive argues that its system, which places different ads in a game depending on the context, can enhance a game by making it more realistic. Davis vows to never disrupt the feel of a game by, say, placing a pizza ad in a fantasy title.

“Advertising in the (baseball) game is additive. It makes the game better, it makes it more realistic because when you go to a stadium to watch a game, you see advertising around the stadium,” Davis said.

Anthony Chau, a spokesman for 2K Sports, the sports brand of Take-Two, agreed.

“Not only are we enabling ourselves to find a new means of profit, but we are adding more realism to the game. At the same time, we don‘t think it‘s intrusive,” Chau said.

Massive‘s ad-tailoring system relies on the gaming machine having an Internet connection. Thus, the ads in the baseball game will only be seen on the version for Microsoft Corp.‘s original Xbox Xbox console, which can be hooked up to the Xbox Live network.

Privately held Massive is backed by $20 million in venture capital. It rolled out its system more than a year ago, and says it has signed up 37 publishers and developers that have already placed ads in nearly 70 games.

Rated M for Mad Ave (Feb. 27, Business Week)

With 100 million gaming U.S. households, according to Forrester Research Inc., and folks increasingly interacting with a video screen instead of passively watching TV, no wonder Nielsen forecasts that ad spending on brand placement in games will balloon from $75 million last year to as much as $1 billion by 2010.

(Story)

| DFC: Don’t Get Hopes Up on In-Game Ads | |

| By Kris Graft | |

| Game industry research firm DFC Intelligence states that significant in-game ad revenue is five years away, and will likely remain only a secondary revenue stream for some time. | |

In a research summary, DFC also noted that the gaming sector that is creating the most ad revenue is casual online gaming, not product placement within MMORPGs or other more “hardcore” online games. In a research summary, DFC also noted that the gaming sector that is creating the most ad revenue is casual online gaming, not product placement within MMORPGs or other more “hardcore” online games.

In-game ads in casual games are relatively easy to make visible, and therefore more effective, because the ads can be displayed around the gameplay area while games are being played in a web browser. Visibility combined with the fact that casual gamers spend a lot of time on casual gaming sites makes for a much more successful means of advertising when compared to a neon sign for Axe body spray that you may pass by in Splinter Cell. Large casual game sites reportedly sell out their ad inventory regularly, thanks to the attraction of tens of millions of unique users each month. The research brief also makes a point that consoles that push an “always-on” connectivity are better targets for advertisers, and not because of potential dynamic in-game product placement that is supplied by companies such as Massive. The article makes specific reference to the potential of the Xbox Live Marketplace, which features opt-in ads such as downloadable game demos, as well as the opportunity for display ads within casual Xbox Live Arcade games. Reiterated within the article is the accepted point that in-game advertising’s biggest hurdle is getting games online. Most gamers within the coveted young male demographic still play games offline, which isn’t conducive to dynamic advertising. DFC concluded that there is a lot of potential for in-game advertising, but the industry has to be realistic about when and to what degree the phenomenon will take off. It may not be the explosive revenue stream that people are expecting; at least not in the short timeframe that many expect. |

|

| Advertisers await game measurement

The lack of an objective audience measurement is putting a speed bump in the growth of in-game advertising that seeks to reach the coveted demographic. |

| By Paul Hyman Jan.26, 2006 (link in story added by media educator Frank Baker)

If advertisers aren’t spending more on in-game advertising these days, it’s probably because they’re holding back, anticipating a metric that will track and measure game usage much the way radio and TV reach-and-frequency is measured, analysts say. But the next-generation game consoles — with their complex technologies — are playing havoc with efforts by Nielsen Interactive Entertainment (NIE) to devise such a measurement. (Nielsen Entertainment is owned by VNU, the parent company of The Hollywood Reporter.) Exactly a year ago, Nielsen said that, by the second half of 2005, it would be supplying PC and console developers with “tags” that could be built into game software to be used by Nielsen to measure all sorts of in-game activity, especially response to advertising. This includes how people navigate through games, what levels they reach and how long they spend on each level. However, the “inaudible audio codes” of the tags proved to be incompatible with the inner workings of the games being designed for the next-gen consoles — Microsoft’s Xbox 360, Sony’s PlayStation 3 (PS3), and Nintendo’s Revolution. And now, says, general manager Michael Dowling, NIE is pursuing an alternative technology based on API (Application Program Interface) calls. But whether that technology will work with all the new consoles is still an open question. While Microsoft released its new console in November, Sony and Nintendo still have not announced when they will release theirs. It’s widely accepted that U.S. shelves will be stocked with Sony PS3s by this spring, but some industry analysts aren’t so sure. “Spring is right around the corner and we haven’t seen a final box or running demo yet,” says Paul Jackson, principal analyst at Forrester Research B.V. in Amsterdam. “Sony’s decision to use the Cell processor and Blu-ray discs — brave as it is — is going to cause Sony a lot of difficulties in terms of producing a box for a reasonable price and getting a sufficient number of boxes ready this year.” As a result, Jackson doesn’t forsee a PS3 launch outside of Japan until autumn 2006 at the earliest. “Sony may pull something out of the bag and surprise us all, but I think it’s fairly unlikely that we’ll see the PS3 in the States until Thanksgiving, one year behind Microsoft’s Thanksgiving 2005 Xbox 360 release,” he adds. Because the Nielsen project is so dependent on the launch of the PS3, Dowling predicts the Nielsen system won’t be up and running before the second or third quarter of 2007, which will certainly delay advertisers’ decisions to invest in gaming advertising, he adds. “This is such a new market for advertisers that only some are willing to test the waters before knowing what they’re getting for their money,” he explains. “They see the value of video game advertising in that this is a highly sought-after demographic and difficult to reach through other media. And they’ll base their decisions on some of our data that we’re doing in a custom fashion. But, for video game advertising to hit critical mass, we need to have that ongoing metric. That’s when we’ll see explosive growth, like the 56% compounded annual growth we saw in Internet advertising, which we believe is largely due to the measurability of that medium. We think we’re going to see similar types of compounded annual growth for video games once we get measurement.” At Forrester Research, Paul Jackson agrees that advertisers are waiting for someone to measure the effectiveness of in-game advertising. “If you talk to companies like Massive Inc. [which serves dynamic advertising onto video games], they will say that they know who is seeing their ads,” Jackson says. “But what many advertisers are waiting for is somebody who’s independent to say, yes, that cola ad got 200,000 impressions within the game ‘Splinter Cell’ last week, for example. Absolutely nobody is publishing what could be classified as extensive data on that as of yet.” Jackson’s research underscores the fact that video games are an ideal medium for reaching the elusive young male demographic, he says. In his paper published in September, Jackson reports that, of the 12-17-year-old online consumers in the U.S. and Canada, 94% own some sort of gaming device, with home PCs — at 85% — ranking as the number one playing technology. Meanwhile, he says, a majority of young online males (55%) would rather play games than watch TV. And most of them — almost 60% — would accept more product placement and advertising in games if it does not interfere with the game or of it reduces a game’s price. “Not only is this demographic predisposed to picking games over, say, music or radio or TV, but the level of engagement is higher than in passive listening to radio or TV,” he explains. “If you’re in the middle of playing ‘Halo 2,’ for instance, there’s no way you can get up and walk away as you might if a commercial came on TV. Video games engage you.” Jackson believes that the fledgling in-game advertising field — especially where dynamic ads are served into an online game much the way commercial time is purchased on radio or TV — has a lot of potential. “It used to be that an advertiser needed to contact the publisher 18 months before a game’s release so that their product could be built into the game,” he says. “There was no way to update it because, once the game was shipped, you were stuck with it. If you decided to change your product or not to market it, it was a bit too late.” While Nielsen works on its efforts to measure gameplay, Jackson advises that there’s no need to wait before sticking a toe in. “If you’re confident that you know how to do advergaming well, if you believe there’s a sufficient audience for your product, if getting some kind of independent metrics of how well the audience received your message isn’t important to you, I say go for it,” he notes. “The people who are offering the ads will say that they’ll tell you how many people saw it, during what period, how many times the ad was served, and at what time. You are relying on their integrity to provide valid data. I have no reason to suspect they aren’t, but just remember that the whole ad industry is built on getting objective metrics.” At eMarketer, senior analyst Debra Aho Williamson agrees: “Certainly companies like to base their advertising decisions on reliable data, and the more data they have to support those decisions, the better. I’m sure that if Nielsen starts to offer objective metrics, marketers will be very interested in it.” Without such data, says Williamson in her October study of “Kids & Teens: Blurring The Line Between Online And Offline,” the challenge for marketers and media firms is that today’s young consumers “are just plain hard to pin down. They are immersed in the digital lifestyle and yet sometimes it’s like they’re using the SparkNotes version of media, dipping in just enough to get what they need and then moving on to something else. Youth marketing is flush with online product placements, sponsored games, and ring tone promotions.” The challenge, she says, is to determine “what the kids think is cool, which can change at the drop of a hat.” While ad agencies had expected Nielsen’s “tags” to fuel advergaming in 2006, NIE’s Dowling says that his company has generated a lot of useful data that can help better assess advergaming opportunities. “That will be helpful for certain companies that don’t feel they need 100% measurability in order to participate,” he says. “But, for video games to be a true media type, it’s going to have to be measured eventually, because any medium that’s not measured is undervalued. And we’ve seen that time and time again.” Courtesy of The Hollywood Reporter — — Paul “The Game Master” Hyman was the editor-in-chief of CMP Media’s GamePower. He’s covered the games industry for over a dozen years. His columns for The Reporter run exclusively on the Web site. |

|

RACE FOR ADS: A computer image by gamemaker Activision shows a Jeep embedded in ‘Tony Hawk’s Underground 2.’ Marketers say it’s now possible for cars in games to have radios that stream live-audio ads. ACTIVISION/AP/FILE |

|

|

In-game ads link to the real world

| Staff writer of The Christian Science Monitor 1/25/06

Even a virtual soldier gets hungry sometimes. That’s why one new firm is helping Subway, the sandwich chain, embed advertisements for its $2.49 daily specials in the video game Counter Strike. The real ads – still in test mode – appear on signs an alert gamer encounters while patrolling a virtual city.And they appear to deliver. The company, Engage In-Game Advertising, surveyed online players recently after they had encountered the ads and recorded 94 percent recall. That’s a “phenomenal” result compared with other media, says David Smith, vice president of business development for Engage in San Francisco. Subway’s sales numbers also spiked in the test market. Product placement meant to foster brand affinity has been commonplace in video games for several years. The practice is widely embraced by gamers, who prize realism – a FedEx delivery truck as opposed to a generic one, for example, in a street-racing game. But “this is more,” says Mr. Smith. “This is actually immersing traditional advertising, like billboards, into the games.” The ads are local-market specific, and can be updated by means of an Internet “patch.” The move is the latest step in marketers’ ongoing bid to capitalize on the rising number of PC- and console-based games that include, if not require, an online component. It has some watchdogs worried that more ads will pitch to younger-than-intended gamers. Though many games are targeted to older teens, members of the age 12-to-17 set are most likely to play, according to one 2004 study. “In-game advertising is here to stay, and will increase as more games and platforms hook up to the Internet,” says Jeff Greenfield, executive vice president of 1st Approach, a marketing firm in Dover, N.H. “Gamers love the reality, and brands are excited about reaching their core demographic.” It’s a willing audience. “This new generation of consumers does not consider its experiences ‘authentic’ unless advertising is involved,” says Mario Almonte, a vice president at Herman Associates, a public relations firm in New York. Soon, new gamers might not recognize ad-free games. In fall 2004, two companies, inGamePartners and Massive, began experimenting with enhanced versions of product placement, including multiplayer online games that could be played free if a gamer agreed to view ads. Then, early last year, Sony Online Entertainment formed an alliance with Pizza Hut centered on the fantasy role-playing game Everquest. A player can type “pizza” to open a browser window and order home delivery. Today, one in-game advertising insider speaks excitedly about games in which a 3-D city might resemble New York’s Times Square, ablaze with ads. Already in the works: in-game ads that replicate broadcast advertising formats. For example, a car in a video game can have a radio that streams live-audio ad messages, says Justin Townsend, chief executive officer of IGA Partners Europe, a leading global player in in-game advertising. As for in-game television ads: “That’s very close on the horizon,” says Mr. Townsend. “Our next software release will actually allow us to place TV spots inside games.” Some observers, including Mr. Greenfield, do not yet see clear evidence that in-game ads will cause youths to buy more. Greenfield also maintains that too much ad clutter could actually annoy gamers and even trigger retaliatory hacking. “This is a rebellious group,” he says. Already the Pizza Hut order option has been derided on some websites, says Steve Mounsey, a 20-something gamer who manages a GameStop store in Beverly, Mass. “A lot of people make fun of that.” Still, few marketers are likely to resist the potential gold mine. Big recent studies – including one in November by Mediaedge:cia and another, just last month, by Nielsen Entertainment and gamemaker Activision – show relevant, well-integrated in-game ads to be remarkably persuasive among 18- to 34-year-old males, a group marketers have found to be elusive of late. “The consumer is no longer sitting in front of the TV set, and brands have to be more innovative in terms of engaging that consumer,” says Claire Rosenzweig, executive director of the Promotion Marketing Association (PMA), a nonprofit research and educational organization. “What you see is an incredible rise in experiential marketing, and ‘advergaming’ can be included in that branded experience.” (Advergames typically promote a single product or brand.) The PMA’s stand on this avenue for ads: The industry should educate, rather than regulate. “Give people information about what it is they’d be engaging with,” says Ms. Rosenzweig, “and let them make informed decisions.” But all of that access to eyeballs, in the hands of a still largely self-policed marketing channel, has more independent watchdogs concerned. In some cases, in-game ads might thrill marketers by providing useful feedback on gamers’ personal preferences – vehicle colors, for instance – raising privacy concerns. And parents rattled by the likes of Grand Theft Auto may now wonder what kinds of ads might eventually flow through such games, many of which are played by younger teens, despite a ratings system. “It’s virtually impossible to know what kids are doing,” especially as gaming goes mobile on hand-held devices, many with wireless Internet connections, says Susan Linn, cofounder of the coalition Campaign for a Commercial-Free Childhood. She suggests that parents lobby Congress to get the Federal Trade Commission involved. “We need to have some laws about marketing to children,” says Ms. Linn, as what she calls “interactive advertising” broadens its reach. IGA’s Townsend counters that it is in advertisers’ interests to protect their brands from image problems. Clients already can schedule ad campaigns that preclude games that feature alcohol or violence. He adds that opt-out rules apply to in-game ads, and he says firms like his are not seeking to mine for private consumer data. “If you were to remove any regulations regarding privacy, it would be an advertiser’s dream,” he allows. “[But] there are regulations in place already that prevent people from working with that data.” |

Advertising to Be Incorporated Into Virtually All Video Games in the Near Future

While consumers actively try to block advertising with tools such as spam filters, pop-up blockers, the mute button and digital video recorders, there are sound reasons for consumers’ receptivity to advergaming. One reason is that the appearance of corporate logos makes video games appear more realistic. For instance, gamers who drive through virtual towns in which signs for Coca-Cola and Nike appear have a more realistic experience that they would if the signs merely advertised Soda and Shoes.Another driver of advergaming is its tight integration with commerce. For example, some advergaming companies have arranged agreements with pizza chains whereby gamers can simply click on a banner to have their favorite pizza delivered to them without interrupting game play.

Mr. Wanetick said, “Advergaming is clearly on a rapid growth trajectory as it is projected to generate $4 billion in revenues by the end of 2008. We are delighted to provide two forums in which advergaming will be discussed by the nation’s foremost practitioners.”

GAMING TARGET: Video games

have plenty of space an advertiser could use.

Need For Speed Most Wanted,

the games latest version, pictured,

features advertising.

Advertising hits video games

17 January 2006

When BP Lubricants United States wanted to raise the profile of its high-performance Castrol Syntec motor oil with ever- elusive young male consumers, it followed them into a popular racing video game.

Like its peers, the unit of BP needs to be where males aged 18 to 34 have gone after abandoning traditional media outlets such as magazines and television in droves.

“We have to look for new ways to reach these guys,” said Michael DeBiasi, the marketing director who oversaw the campaign.

The Castrol brand’s integration into Electronic Arts’ Need for Speed Most Wanted game appeared in the form of billboards, Syntec car engine upgrades and signage in garages, and as Castrol-branded Quick Lubes.

Through its website, the brand also provided gamers with a “cheat code” that allowed them to unlock a high-performance Castrol Syntec Ford GT to drive in the game, something DeBiasi said players appreciated.

DeBiasi would not disclose what the company paid for this exposure. “We feel like it was a very effective and efficient buy,” he said.

Such advertising has been slow to catch on, even though the $US10 billion US video-game market now rivals Hollywood box-office sales – and despite a widely held view that the medium offers big opportunities for product placement and branding.

Nielsen Entertainment expects US ad spending in console and PC games for this year to come in at $US75 million. It is seen growing rapidly through the end of the decade, when the research firm sees it reaching $US800m to $US1b.

The arrival of next-generation consoles from Microsoft, Sony and Nintendo, which connect more players to the internet and open the door to more innovative and measurable campaigns, should help drive up advertising activity, video- game companies and their potential sponsors said.

The Entertainment Software Association says the average US video game player is a 30-year-old male. “That’s a pretty good sweet spot for an entertainment company like Playboy,” Christie Hefner, chief executive of Playboy Enterprises, said at the Reuters Media and Advertising Summit.

The adult media company this year produced its first video game, a “lifestyle simulation” title called Playboy: The Mansion.

Certain games are innately ripe for advertising. For example, virtual billboards can create a sense of authenticity in racing, sports and urban action games.

“Gamers actually welcome it because it adds realism in games,” said Sam Kennedy, editor-in-chief of video-game-enthusiast site 1UP. com.

Some publishers used to pay to show certain cars in racing games – a situation that has now reversed, he added. Electronic Arts, the world’s biggest video-game publisher, has ads placed in 11 of its 33 games this year. They include sports titles like NCAA Football 06, FIFA 06 Soccer and SSX On Tour in addition to Need for Speed, said Julie Shumaker, director of sales for online and video-game advertising.

Sniffing opportunity, some big advertising agencies have jumped on the bandwagon.

Starcom MediaVest Group was a pioneer in the market, setting up its Play division about two years ago.

Tribal Gaming, part of Omnicom Group, is a new gaming unit with a half-dozen employees. WPP Group’s Young & Rubicam’s Bounce Interactive Gaming division also focuses on ads in games. DeBiasi worked with MarketSource IMS.

Still, EA’s Shumaker says it’s unusual to see an agency involved in a deal. Advertisers tend to hand the work to their ad agencies only after an agreement is reached, she said, adding that she does almost 75 per cent of her deals directly with the client.

“That concerns me,” said Shumaker, who thinks the business needs more agency participation to grow rapidly.

Some advertising executives say in-game advertising has a long way to go to rival other mainstream media.

“I think that one will be a little bit slower in developing,” Brian McAndrews, chief executive of internet marketing company aQuantive, said at the summit.

“You have to be careful in the game environment as to how intrusive you are.”

Meanwhile, the video-game industry is working to deliver the data that companies want to justify spending money on in-game ads.

To that end, Activision and Nielsen Entertainment released their latest study recently, which suggested that video-game ads, when used properly, can increase awareness of a brand as well as positive attitudes toward it.

THQ is the first major video game publisher to support Internet-delivered advertising.

![]()

By Antone Gonsalves TechWeb News

![]()

Dec 19, 2005 04:13 PM

Videogame maker THQ Inc. on Monday said it has agreed to carry in its games ads delivered over the Internet by Massive Inc., a deal that reflects the industry trend towards building an online advertising model for videogames.

The deal is important because THQ, based in Agoura Hills, Calif., is the first major videogame publisher to agree to start carrying Internet-delivered advertising. The game maker, whose popular titles include “SpongeBob SquarePants” and “World Wrestling Entertainment,” did not disclose financial details.

New York-based Massive is building an advertising network of videogame makers who build games for the PC and other Internet-connected devices, such as Microsoft Corp.’s Xbox or Sony’s PlayStation. The company, which launched in October 2004, says it has partnerships with 29 publishers, and more than 60 advertisers, including Coca-Cola, NBC, Nokia, Panasonic and Paramount Pictures.

“We are excited to team with Massive because we believe their network strategy and sensitivity to game play will deliver value to publishers, advertisers and gamers,” Kelly Flock, executive vice president of worldwide publishing at THQ, said in a statement.

In-game advertising has been gaining momentum among publishers as a way to offset the high cost of development of next-generation games, Anita Frazier, analyst for The NPD Group, said.

“With development costs escalating, in-game ads offer publishers another way to make money, outside of pure retail sales,” Frazier said.

Videogames offer advertisers the ability to reach mostly males between the ages of 18 and 34, a prime demographic that’s difficult to reach because they tend to watch less TV than other age groups.

“This is an audience that’s very difficult to target, but videogames are a tremendous medium for that audience,” Nicholas Longano, chief marketing officer for Massive, said.

Showing ads in games, however, presents a risk to publishers, who could quickly turn off players. To avoid that, ads are shown only where they can blend into the game environment. As a general rule, action games that take place in modern times, or the future, make good candidates, as well as racing and sports games, Longano said.

“You don’t expect to see advertising in a Middle Earth setting,” Longano said, referring to the world created in the “Lord of the Rings” fantasy books. “It wouldn’t make any sense.”

Pricing for advertising varies according to the size, angle at which it is shown and the amount of time it’s on the screen. Ads are usually sold in 10- or 15-second time slots, and can change continuously, according to the dynamics of the game. A Coca-Cola ad, for example, could be on a billboard in one scene and on a Coke bottle in another.

Full motion video ads can also run where it makes sense, Longano said. An example would be in a game that recreates Times Square in New York.

Under the multi-year deal, THQ is expected to start carrying Internet ads in about 10 percent of its games, increasing the pool over time, Longano said.

Monday, December 19, 2005

Targeted Ads Coming to Games, Mobile TV

Fine-tuned ad technologies are expected to advance in 2006.

By Associated Press

BOSTON (AP) — MobiTV Inc. built its business by sending TV broadcasts to cell phones. People willing to stare at the small screen for extended periods can tune in channels such as ESPN and MSNBC.

But MobiTV recently began doing more than just relaying the signals. Now the company removes some ads that appear on TV broadcasts and replaces them with ones geared for wireless viewers.

Here’s the logic: Consumers willing to pay for TV on a cell phone tend to be more affluent, urban and tech-savvy than the average viewer. So why should they get the same ads as the average viewer?

Waning are the days of blasting a commercial to a vast network audience and hoping someone out there responds.

Technologies will emerge in multiple realms in 2006 and beyond — from video games to cable TV to podcasts — that will give advertisers intriguing abilities to pinpoint designated segments of the public with specific messages.

”We’re now entering a new age where the advertising doesn’t have to be intrusive, irrelevant, bombastic — shotgunned advertisements in which we make everyone learn about dog food even if they don’t have a dog,” said Paul Woidke, vice president of technology for the ad division at cable giant Comcast Corp.

Such fine-grained marketing has long been predicted for the digital age because of the demographic and behavioral tracking it enables.

Perhaps the idea’s ultimate extension appeared in the 2002 sci-fi movie ”Minority Report,” when the main character, running for his life, is spotted by a billboard that proclaims, ”John Anderton, you could use a Guinness about now!”

Putting the concept into practice on the Internet has been bumpy. Many Web surfers recoil at ”adware” — or more derisively, ”spyware” — software that monitors their clicks to serve up ads presumed to matter to them.

That’s not to say the idea is dead — Claria Corp., formerly known as Gator Corp., has resurrected its business of delivering personally targeted Web ads now that it is moving away from doing it with pop-up windows.

But the real innovation in targeted ads these days seems to be occurring in other media platforms.

Consider the service that Massive Inc. launched in 2005 to feed ads to video games.

It was possible beforehand to put ads in video games, such as on the billboards that would appear around the track in auto-racing games. But those had to be programmed into the game, often a year before the title’s release.

By working with game programmers, Massive built a system that can feed ads in real time to games played on the Web or networked console services like Xbox Live. Now those ads around the track on auto-racing games can change depending on when and where the game is being played.

Movies opening in limited release in European cities have been pitched to game players only in those areas. The WB Network placed ads in games during prime-time hours in the days before launching a new show.

Massive’s ads appear in context so as to minimize annoying players. So while a street-fighting game might show a Pepsi truck driving by, there tends not to be any product placement in fantasy titles that draw gamers seeking escapism.

But the next step is a bit tricker. Massive is exploring ways that ads can be directed to certain players, depending on demographic criteria. That would require players’ permission and willingness to proactively register their interests — beyond, of course, what their choice of video game says about them.

Advertising enters storylines; meet Nokia in video games

| Luxury brands TAG Heuer, Bang & Olufsen, and Lacoste are targeting a group of people you wouldn’t expect: 18- to 34-year-olds who spend hours playing video games.A study released recently concludes that people who view advertisements in video games have better brand recall, and in some cases are more likely to favorably change their opinion about a brand, than consumers who view television product placements.

‘‘It took a lot of convincing to persuade Bang & Olufsen that gamers are the same people who go into their stores and like playing on the plasma screens they sell,” said Arden Doss, managing director of Propaganda GEM, an entertainment marketing firm in Los Angeles. ‘Everyone — even luxury goods clients — realizes that the twentysomething male is off playing video games, not watching TV.’’ Once considered the sole territory of awkward teenagers, video games have lured an estimated 20 million young males, and with them a rapidly growing number of advertisers. As the highly coveted group of 18- to 34-year olds spends more time with Xboxes and PlayStations than watching prime-time television, in-game advertising is expected to grow eight times to $562 million in 2009, making the nascent industry one of the fastest-growing marketing segments, said Michael Goodman, a video game analyst at Yankee Group in Boston. Already, video game publishers have waiting lists of companies angling to promote video ads and get product placements, including in Anarchy Online, a game that takes place 30,000 years in the future and whose free version attracts 2,000 new users around the world every day. Next year, cellphone maker Nokia is doubling to 10 the number of games in which it will advertise, and the world’s largest independent game maker, Electronic Arts, which had one game with ads in 2002, will have product placements in at least half of the 30 titles it releases next year. Part of the reason is that video game advertising has evolved beyond a billboard ad on a screen. Now, companies can feature dynamic commercials and intertwine their brands into the story lines of games, such as a murder victim who was about to sign a contract with fashion designer Lacoste in the ‘‘Law & Order: Justice is Served’’ game. Meanwhile, Bang & Olufsen will showcase its high-end electronics stores along with Swiss watchmaker TAG Heuer in Tycoon City: New York, an Atari game due early next year. ‘‘Advertisers have built their business on finding ways to interrupt consumers, and that is fundamentally in conflict with how you effectively advertise in gaming,’’ explained Julie Shumaker, director of sales for Electronic Arts. ‘‘We have to think about how it flows with the game experience.’’ The growing popularity is transforming the video game landscape and making some games longer and allowing publishers to offer free versions of their games that are totally supported by advertisements. Just a few years ago, video game publishers were paying car companies like Corvette to use their brands in games. Now, the tables have turned, and brands such as Jeep are paying to be in Activision’s ‘‘American Wasteland’’ out this holiday season. Costs for advertising in video games have grown exponentially. They can range from $5,000 to $500,000, prices that rival spots in small films, according to some agencies. For advertisers, it’s worth it: The average gamer playing, for example, Anarchy Online is 29, male, college-educated, and spends more than 20 hours a week playing video games. Meanwhile, prime-time TV viewership for young men declined nearly 8 percent in 2003, according to Nielsen Entertainment. The 18-to-34 male age group is an important demographic for marketers looking to build brand loyalty and grab consumers who have disposable income. The study indicates that video games can persuade like no other media, said Michael Dowling, general manager of Nielsen Inteactive Entertainment, a market research firm that conducted the study with video game publisher Activision. For example, people who viewed Cingular ads in a car racing video game were 1.5 times more likely to recommend the phone company brand to a friend and two times more likely to rate it very strongly, compared to a control group that saw the video game without the ad. On the other hand, people who viewed product placements for Applebee’s in a ‘‘Seinfeld’’ TV episode were no more likely to recommend the restaurant chain or rate it strongly when compared to a control group that saw the show without the ad. ‘‘If games are supposed to be immersive, sometimes ads can work and add a sense of realism,’’ said Elliot Targum, a 28-year-old teacher in Cambridge who spends about five hours a week playing video games. Although few game publishers have introduced advertising into children’s titles, some consumer groups say it’s only a matter of time. —Jenn Abelson / NY TIMES |

Advertisers explore virtual video game frontier

By Lisa Baertlein

LOS ANGELES (Reuters) – When BP Lubricants USA wanted to raise the profile of its high-performance Castrol Syntec motor oil with ever-elusive young male consumers, it followed them into a popular racing video game.

Like its peers, the unit of BP Plc (BP.L: Quote, Profile, Research) needs to be where males aged 18 to 34 have gone after leaving traditional media outlets like magazines and television in droves.

“We have to look for new ways to reach these guys,” said Michael DeBiasi, the marketing director who oversaw the campaign.

The Castrol brand’s integration into Electronic Arts Inc.’s (ERTS.O: Quote, Profile,Research) “Need for Speed Most Wanted” game appeared in the form of billboards, Syntec car engine upgrades and signage in garages, and as Castrol-branded Quick Lubes.

Through its Web site, the brand also provided gamers with a “cheat code” that allowed them to unlock a high-performance Castrol Syntec Ford GT to drive in the game, something DeBiasi said players appreciated.

DeBiasi would not disclose what the company paid for this exposure. “We feel like it was a very effective and efficient buy,” he said.

Such advertising has been slow to catch on, even though the $10 billion U.S. video game market now rivals Hollywood box office sales — and despite a widely held view that the medium offers big opportunities for product placement and branding.

Nielsen Entertainment expects U.S. ad spending in console and PC games for this year to come in at $75 million. It is seen growing rapidly through the end of the decade, when the research firm sees it reaching $800 million to $1 billion.

The arrival of next-generation consoles from Microsoft Corp. (MSFT.O: Quote, Profile,Research), Sony Corp. (6758.T: Quote, Profile, Research) and Nintendo Co. Ltd. (7974.OS: Quote, Profile, Research), which connect more players to the Internet and open the door to more innovative and measurable campaigns, should help drive up advertising activity, video game companies and their potential sponsors said.

FOUND: THE 30-YEAR-OLD MALE

The Entertainment Software Association says the average U.S. video game player is a 30-year-old male.

“That’s a pretty good sweet spot for an entertainment company like Playboy,” Christie Hefner, chief executive of Playboy Enterprises Inc. (PLA.N: Quote, Profile, Research) said at the recent Reuters Media and Advertising Summit.

The adult media company this year produced its first video game, a “lifestyle simulation” title called “Playboy: The Mansion.”

Certain games are innately ripe for advertising. For example, virtual billboards can create a sense of authenticity in racing, sports and urban action games.

“Gamers actually welcome it because it adds realism in games,” said Sam Kennedy, editor-in-chief of video game enthusiast site 1UP.com.

Some publishers used to pay to show certain cars in racing games — a situation that has now reversed, he added.

Electronic Arts, the world’s biggest video game publisher, has ads placed in 11 of its 33 games this year. They include sports titles like “NCAA Football 06,” “FIFA 06 Soccer” and “SSX On Tour” in addition to “Need for Speed,” said Julie Shumaker, director of sales for online and video game advertising.

Sniffing opportunity, some big advertising agencies have jumped on the bandwagon.

Starcom MediaVest Group was a pioneer in the market, setting up its Play division about two years ago.

Tribal Gaming, part of Omnicom Group Inc. (OMC.N: Quote, Profile, Research), is a new gaming unit with a half-dozen employees. WPP Group’s (WPP.L: Quote, Profile, Research) Young & Rubicam’s Bounce Interactive Gaming also focuses on ads in games. DeBiasi worked with MarketSource IMS.

Still, EA’s Shumaker says it’s unusual to see an agency involved in a deal. Advertisers tend to hand the work to their ad agencies only after an agreement is reached, she said, adding that she does almost 75 percent of her deals directly with the client.

“That concerns me,” said Shumaker, who thinks the business needs agency more participation to grow rapidly.

Some advertising executives say in-game advertising has a long way to go to rival other mainstream media.

“I think that one will be a little bit slower in developing,” Brian McAndrews, chief executive of Internet marketing company aQuantive Inc. (AQNT.O: Quote, Profile, Research), said at the Reuters summit. “You have to be careful in the game environment as to how intrusive you are.”

Meanwhile, the video game industry is working to deliver the data that companies want to justify spending money on in-game ads.

To that end, Activision Inc. (ATVI.O: Quote, Profile, Research) and Nielsen Entertainment this week released their latest study, which suggested that video game ads, when used properly, can increase awareness of a brand as well as positive attitudes toward it.

(Additional reporting by Michele Gershberg in New York)

Advertising: Videogame Makers Try to Score More Ad Dollars With Research —

Study Finds Many Gamers Don’t Mind Product Plugs; A Pitch to Madison Avenue

By Nick Wingfield

5 December 2005 The Wall Street Journal

THE VIDEOGAMES INDUSTRY, on the cusp of technological changes that could make game audiences far more measurable, is taking more steps to tap a potentially lucrative new source of revenue: advertising dollars.

Today, VNU NV’s Nielsen Entertainment plans to release the results of a study funded by Activision Inc., one of largest games publishers, that is the most exhaustive effort yet to investigate the effectiveness of advertising within games. Rather than traditional 30- or 60-second TV-style commercials, advertising in videogames often takes the form of product placements that appear blended into the action on the screen.

A key finding of the research: A majority of gamers in the study found relevant advertising enhances the realism of games, a relief for publishers who worried that players would get annoyed by frequent product promotions. “This is building a stronger case for valuing the medium,” says Michael Dowling, senior vice president at Nielsen Entertainment.

Better research on ads in games could help further pique Madison Avenue’s interest in the medium, just as new game consoles like Microsoft Corp.’s hot-selling Xbox 360 are expected to greatly expand online gaming, a technological shift that will give advertisers greater power to figure out how frequently and what types of gamers see their promotions when they, say, hop on a virtual motorcycle and jump through hoops sponsored by a candy-bar maker. Internet-connected consoles could also increase interest in delivering fresh ads over the Internet.

The Nielsen study is part of an effort by the media-research firm and Activision to lay the groundwork for more-serious advertising in a medium that had $25.4 billion in world-wide sales last year, according to PricewaterhouseCoopers LLP. In a study last year, Nielsen found videogame playing is eroding television viewership among men 18 to 34 years old, results that have been echoed in other research of media consumption. While Activision has funded Nielsen’s games research, Nielsen says results aren’t influenced by the publisher.

Nielsen’s most recent study followed 1,350 active male gamers ages 13 to 44 as they played various games, including an Electronic Arts Inc. racing game in which players pass billboards and receive instructions through message windows sponsored by Cingular Wireless, the cellphone provider owned by AT&T Inc. and BellSouth Corp. The study found 69% of participants recalled seeing the Cingular ads.

While most game publishers are already experimenting with promotions within their games, executives say ad revenue is minuscule. Executives say advertisers currently can pay several hundred thousand dollars to have their brands appear in games, though deals are often struck in a willy-nilly fashion. Games publishers would clearly like to get more money for serving up a prized, highly attentive demographic.

Bobby Kotick, Activision’s CEO, says the company hopes to use data from the Nielsen study to develop a “rate card” for game advertising — a more systematic approach to charging for various levels of promotions in games, including everything from the billboards that users zip by on virtual ski slopes to branded vehicles they hop into on the lam from the police.

Mr. Kotick says new game consoles — including Xbox 360 and Sony Corp.’s PlayStation 3 due out next spring — will also help build the foundation for more advertising in games because they are expected to be much more widely connected to the Internet than current consoles like the original Xbox and PlayStation 2. “You have ability to track millions of interactions” with advertisements, Mr. Kotick says.

Microsoft has quietly formed a team focused on exploiting the advertising capabilities of Xbox 360. The company has made it much easier for Xbox 360 users to get connected to the Internet and expects more than half of gamers on that console to be online, compared with 10% to 15% of original Xbox users who are online.

Being connected to the Internet “takes advertising in the gaming environment to a whole different level,” says Aaron Greenberg, group marketing manager for Xbox Live at Microsoft.

People familiar with the matter say Sony is also looking more seriously at advertising in games as well. A Sony spokesman didn’t respond to a request for comment.

Consoles connected to the Internet can also receive fresh ads regularly delivered to them in games, as is becoming commoner in games played on personal computers. It is already starting to happen: Since September, players of a combat game from French publisher Ubisoft Entertainment SA called Rainbow Six Lockdown have seen ads piped into the game over the Internet on the original Xbox through a game advertising company called Massive Inc.

—

Overload Of Game Ads Could Defeat Purpose

Wed Nov 30, 7:10 PM ET

A new report released by Mediaedge:cia analyzing in-game advertising cautions against marketers potentially flooding the gaming universe with ads, as it also throws some cold water on a few of the more exuberant spending predictions for the industry.

Expectations for the burgeoning in-game ad space have risen precipitously over the past year, particularly as companies like Massive Inc. have launched networks that offer the capability of serving live ads within games played with an Internet connection.

The Yankee Group forecasts that in-game advertising will reach $800 million in spending by 2009, while Massive CEO Mitch Davis claims that ad revenue will skyrocket to $2.5 billion by 2010.

However, MEC’s report, “Playing with Brands: Engaging Consumers with In-Game Communications,” which praises the effectiveness of well-executed ads, warns against marketers forcing messaging into games. It is based primarily on commentary from gamers, some of whom cited those well-executed ads. According to the report, “using games simply to ‘reach’ or interrupt people cannot be regarded as an effective use of a channel with such potential.”

Instead, the ads need to “enhance a game’s alternate reality,” said the report, with the best actually making the game better. This means creating highly customized ads for individual games, which makes it tough to execute an ad buy on a massive scale–and for the ad medium to grow quickly. “Taking an ad formula and applying it across categories and brands that’s not the way to go,” said Fran Kennish, director of strategic planning at MEC, who added that some in-game ad spending estimates may be overstated. “You may end up doing more harm than good.”

STUDY PROBES ATTITUDES TOWARDS IN-GAME ADS

NEW YORK (AdAge.com) – With video games becoming mainstream ad vehicles and marketers expected to spend $185.6 million on ads in games in 2005, figuring out what kind of ads gamers will accept is becoming crucial.

|

||

DOWNLOAD Item:

|

Authenticity seems to be the watchword for gamers the world over, according to a new study by Mediaedge:cia. In the U.S. alone, 150 million people play video, electronic or online games.

On average, U.S. gamers play between three to four hours over a week, and heavy gamers devote 11 hour. The hours spent on gaming demonstrate how passionate gamers are about this pursuit, but that doesn’t mean they are averse to ads.

“We were pleasantly surprised by the acceptance of advertising if it’s done in the right, subtle way and helps to increase the gaming experience,” said Fran Kennish, director-strategic planning for MediaEdge:cia.

Game enhancers

In fact, gamers say that advertisements even enhance the game experience when they help to create the alternate reality.

Advertising placements that mimic real-world ads, such as billboards in sports or racing games, are accepted by gamers because they are perceived to add to the reality of the game, according to the study.

“I’ve played many baseball games and have been a little upset every time Fenway Park is played; there is usually no Citgo sign. That Citgo sign has practically become synonymous with Fenway Park and the Boston Red Sox,” said one unnamed respondent quoted in the study.

Heavy gamers have the most positive experiences with advertising. Male gamers in particular claim ads make the game more realistic, especially if they help the player reach a certain objective.

“In ‘Metal Gear Solid 2,’ when you opened up the enemy’s lockers, you could see FHM posters inside [featuring] beautiful girls in swimsuits,” said a respondent, talking about ads enhancing reality.

Delicate balance

But, the study cautions, “There is a delicate balance between enhancing realism and obstructing escapism.” In theory, all games are possible venues for placements, though sports and racing games lend themselves to the medium better. It is nearly impossible to place a modern brand in a sword-and-sorcery epic or a futuristic sci-fi game. “I’d hate to be playing some shooter set in 2275 and see an ad for a 2004 Jeep Cherokee,” said a respondent.

Another respondent pointed out that if the main character in, say, “Grand Theft Auto” remarks that he’d “‘never go out and kill someone without my Red Bull energy drink.’ That could ruin a game because it disrupts game flow.”

The bottom line? “If it’s subtle and fits in, it’s perfect,” Ms. Kennish said. “Anything else would not fly.”

The study was conducted through surveys on blogs and polled more than 250 gamers in nine countries

Advertisements to invade online games

SAN JOSE, Calif. – Here you are, one of the millions of Americans who like to play casual games on the Internet, ready to log on for some fun. So you go to a gaming Web site and try to ignore the ads on the page. Then you wait as the game loads and a 10-second advertisement covers your computer screen. Ah, the start button. Now you can play, but don’t expect the virtual escape to guarantee relief from marketers’ attempts to get in front of your eyes. On Monday, online game provider Shockwave.com will begin offering advertisers a way to insert ads within the games themselves. While it’s believed to be the first such invasion in Web-based games, it’s only one of a growing number of venues advertisers are using to reach its shifting and fleeting audiences. The traditional pillars of advertising in print and television media have eroded in recent years as people – especially the elusive demographic of young men – have instead spent more time on video games and on the Internet. Hence, the ad creep, whether loudly from the walls of sports fields, subtly from the strategic product placements within films, or annoyingly from the pop-up ads all over the Internet. There’s no respite even when people use their TiVo digital video recorders to skip TV commercials: earlier this year, banner-like ads started appearing during the fast forwarding process. Ads are also showing up in console video games. It was only a matter of time then that in-game advertisements would arrive in the world of casual Web-based games. The often addictive genre of action, puzzle, and card games attracted nearly 56 million unique visitors in September, according to comScore Media Metrix research firm. Already, advertising revenue from online games, including the more hard-core multiplayer games, is projected to grow to $1.1 billion by 2008, up from between $450 million and $550 million last year, according to the Yankee Group research firm. Shockwave.com, a division of San Francisco-based AtomShockwave Corp., wants to capitalize on the growing migration of advertising dollars to the Internet. “There’s such a huge demand right now from brand advertisers,” said Dave Williams, chief marketing officer of AtomShockwave. “And this is a huge audience, and an engaged audience.” Shockwave.com hosts more than 200 games and claims its 20 million visitors to the site last month played more than 25 million game sessions. The advertising network to be launched Monday will allow marketers to insert their images or brand names right inside the games. They’ll be able to track the “impressions” or viewing times each ad gets – a key advertising metric – as well as tailor their ads to geographic markets. SBC Communications Inc., Sprint Nextel Corp. and Sony Pictures are among the first companies planning to use Shockwave.com’s new advertising feature. Shockwave.com plans to start ad insertions with action games, where the landscape, say of a racing game, or sport, lends itself to billboard-like advertisements. For instance, in the game called “SWITCH Wakeboarding,” players will soon see bright yellow Sprint Nextel ads interspersed on ramps as they buzz around the lake doing tricks. In the game, which usually lasts about 15 minutes, a player might see ads as many as 25 times, Williams said. Ad images will generally last from three to seven seconds in action games, and perhaps longer in other games where an ad can be displayed, say, on a hood of car, instead of a passing object, Williams said. Shockwave.com plans to later introduce ads in mind and puzzle games, too, but only if they could somehow be incorporated into the design without interfering with the game play. Players should never see an ad that will pop up and block their views as they’re maneuvering their marbles, tiles, or jewels in a puzzle game, Williams said. “Consumers are not screaming for more ads,” he said, “And we want to make sure that as we roll this out, that the places where you’ll see the ads will be where you would expect to see them in the real world as well.” |

Game Consumers ‘Tune Into’ Video Ads

By Colin Campbell 10/17/2005

Online advertising outfit Eyeblaster has published a joint survey with casual games portal WildTangent showing that online gamers are happy to watch video ads in exchange for free gaming sessions.

ImageOnline content providers are increasingly turning to a TV-style model of video advertising embedded with programming. Games content sites often ‘make’ consumers watch an ad before accessing requested video or interactive content.

In the survey, 78% of respondents agreed with the statement ‘I would watch a short video ad in exchange for free game plays’, jumping to 90% among young adult males.

Gal Trifon, Eyeblaster’s president and CEO said, “The scope of this survey leaves little doubt about the conclusion that video ads are the perfect match for advertisers who want to target the gaming audience.

“A very strong validation of this advertising model is demonstrated by the fact that more than 97 percent of the hard to reach category of males 18-34 surveyed would return to WildTangent to play free games after viewing an ad. Pre-roll video is an extremely effective means of reaching these consumers, who are overwhelmingly utilizing broadband connections and are among the savviest of all users on the web today.”

In-Game Advertising: Fastest Growing Advertising Segment Proven to be Effective by New Double Fusion and Nielsen Interactive Entertainment Study

Monday October 3, 8:00 am ET

All In-Game Ad Formats Substantially Drive Awareness and Recall; 3-D Advertising the Most Effective

The study looked at a variety of advertising insertions within the downloadable version of London Taxi, a PC game published by Metro3D. The objective of the study was to assess the brand impact of advertising within the recently released game environment, and to compare the efficacy of the different types of advertising formats supported by Double Fusion’s in-game ad serving technology.

Together, Double Fusion and Nielsen Interactive Entertainment conducted a pre- and post-exposure study exploring changes in ad awareness, recall and purchase intent for a Procter & Gamble product called Flash Car Wash, a new cleaning product distributed in the United Kingdom. As part of the study, Nielsen also looked at user attitudes towards the presence of real advertising within the game.

“The study provides continued evidence that in-game advertising is a medium which brand managers across categories should be exploring, particularly if they want to reach the highly valuable 18-34 year old male audience,” said Henry Piney, managing director Europe, Nielsen Interactive Entertainment. “What we learned is that even for new brands, the impact that in-game advertising can have is significant. The study also shows that, by using video games’ unique attributes and offering insertions through which players can interact with brands, the advertiser can gain even greater value.”

“Video games are the fastest growing consumable entertainment medium on the market,” said Guy Bendov, co-founder and executive vice president for business development, Double Fusion. “More and more 18-34 year olds are spending both time and money on gaming, and reaching this highly desirable audience is of the utmost importance for advertisers and marketers. Double Fusion is the only company in the market that offers the 3-D insertion capability so it is very encouraging to find that this tool resonates with consumers.”

Other key findings include:

– Brand Perceptions – Positive perceptions of brand attributes for the product such as being “easy to use,” “time saving,” “convenient” and “more effective than traditional methods” all showed small but consistent increases.

– General Perception of In-Game Advertising – General perceptions of in-game advertising are relatively positive: in the pre-survey (among 900 respondents) 50 percent of respondents agreed that in-game advertising makes a game more realistic while only 21 percent disagree. Likewise 54 percent agreed the in-game advertising ‘catches your attention,’ while only 17 percent disagreed.

Study: Gamers Responsive to Ads

October 03, 2005

By Mike Shields

http://www.mediaweek.com/mw/news/interactive/article_display.jsp?vnu_content_id=1001219920

Gamers in London have proven quite responsive to in-game advertisements, according to new research released by Nielsen Interactive Entertainment.

The new Nielsen study was conducted in conjunction with Double Fusion, an Israeli-based firm that is one of a handful of company’s promising to enter the burgeoning in-game advertising market in the U.S. Via both a pre- and post-exposure study, Double Fusion attempted to gauge the responsiveness of folks playing the online game London Taxi to an ad campaign from Procter & Gamble for a new cleansing product, Flash Car Wash.

According to the study, awareness of the Flash campaign increased by a hefty 60 percent following the brand’s in-game effort. Meanwhile, metrics such as brand favorability and purchase intent exhibited positive, yet more modest gains- perhaps indicative of the limited nature of messaging for in-game ads.

The study also pitted two forms of in-game ad platforms against each other: static billboard ads versus 3-D animated ads. Not surprisingly, 3-D ads, which Double Fusion is touting as its competitive advantage over other vendors, yielded twice the recall scores of static banner placements.

Besides awareness of this particular campaign, Nielsen looked at consumers’ attitudes towards in-game advertising as a whole, and generally, gamers appeared to be accepting. For example, in the 900 person pre-survey, 50 percent of respondents agreed that in-game advertising makes a game more realistic, while just 21 percent disagreed.

“The study provides continued evidence that in-game advertising is a medium which brand managers across categories should be exploring, particularly if they want to reach the highly valuable 18-34 year old male audience,” said Henry Piney, Nielsen Interactive Entertainment’s managing director in Europe.

“What we learned is that even for new brands, the impact that in-game advertising can have is significant. The study also shows that, by using video games’ unique attributes and offering insertions through which players can interact with brands, the advertiser can gain even greater value.”

Double Fusion promises to replicate this test in the U.S., where the in-game advertising market is expected to swell considerably over the next five years. While interest among marketers has surged of late, given the huge video game usage numbers among young males and the emergence of live in-game ad placements from companies like Massive, research on the medium’s effectiveness has been hard to come by.

Nielsen did announce plans late last year that it would begin measuring both video game usage and in-game advertising on the Massive network.

Study: Most Kids Play Video Games Daily; Web Ads Gaining ImportanceInternet marketing is growing in importance as more kids use the PC not only to play games but also to get new info on new titles

ADAGE.COM’S ADVERGAME CHRONICLES

Tracking the Rise of a New Marketing Venue

August 16, 2005

http://www.adage.com/news.cms?newsId=42220

NEW YORK (AdAge.com) — Digital games have reached critical mass as a new mainstream entertainment and advertising medium. Among other things, total sales in 2004 of digital game items in the U.S. exceeded that of Hollywood’s national movie box office receipts. Below, we chronologically look back at our major stories about this market-changing genre of interactive entertainment that continues to emerge as an important new marketing venue.

GRAND THEFT’ FLAP COULD HURT ADVERGAMING BUSINESS

NEW YORK (Adage.com) — The furor over the “adults only” rating slapped on “Grand Theft Auto: San Andreas” could scare off advertisers that were eyeing the $11.5 billion video-game industry as one of the major emerging advertising media.

|

| While ‘Grand Theft’ doesn’t contain any advertising, the controversy it has created with its hidden sex scenes could hinder the recruitment of in-game advertisers for other titles.

|

Following revelations that sex scenes were buried in PlayStation 2 versions of the game published by Take-Two Interactive Software, the Entertainment Software Ratings Board upped the Theft rating to “Adults Only 18+.” That prompted retailers including Wal-Mart, Circuit City, Best Buy and Target to remove the game from their shelves and members of the Entertainment Merchants Association to stop selling it.

Even though “Theft,” the top-selling game on the market, contains no ads, the worst damage may be to the nascent $180 million field of “advergaming.”

Looking to reach ‘lost boys’

The controversy threatens to scare off marketers that have just started exploring, and spending small slices of budgets on ads in games in a bid to reach the “lost boys” — men 18 to 34 who are abandoning TV for Xbox and PlayStation. While advergaming spending is currently small, Yankee Group estimates it will hit $800 million by 2009.

“The advertisers who were thinking about marketing in games and looking for all the reasons to go into the medium will be much more cautious,” said Cory Treffiletti, senior vice president and managing director for Carat Interactive, San Francisco.

“Advertisers will want more guarantees,” said Mike Vorhaus, managing director of Frank Magid & Associates. But he doesn’t think they will bail out of advergaming: “If you want to reach this demographic, you’ve got to go to video games, MTV and ESPN.”

Marketers who have placed ads in games include Cingular Wireless and Burger King, in Electronic Arts’ “Need for Speed Underground 2”; Procter & Gamble Co.’s Old Spice, in EA’s “NCAA Football 2005”; and Samsung, in Atari’s “Enter the Matrix.”

Scared of controversy

While desperate for ways to capture young men’s attention, most advertisers are scared by any hint of controversy, and there’s plenty around “Theft” and similar games.

Last week, Sen. Hillary Rodham Clinton, D-N.Y., announced she would introduce legislation to shield children from “inappropriate” video games, and called on the Federal Trade Commission to investigate this particular title.

Josh Larson, director of industry products at Gamespot, an online news and information forum for video games, expects tighter government controls on the industry as a result. “The government will want to play some role in the regulation of games and that could mean stricter laws about retailers selling the game and carding of individual buyers,” he said.

Still, Dave Madden, executive vice president of sales and marketing at WildTangent, a company which pioneered advertising in online games, doesn’t agree. “This game would be controversial in any case because of the level of violence,” he said. “There’s no risk at all in advertising in a Tony Hawk or a Madden Football. It’s the same level of risk as advertising in a violent movie.”

Stickers and software patch

Take-Two has stopped manufacturing the game and will release a new version in October. It is also disseminating “Adult Only” stickers to retailers and will put out a downloadable software patch. No public relations or ad campaign is on tap, said a spokesman.

The PlayStation 2 version of “Theft” has sold 5.7 million units since it was released during the fourth quarter of 2004, making it the top-selling video game on the market, according to NPD Group. Data are not yet in for the PC and Xbox versions, released in June.

Take-Two lowered its guidance for the fiscal year ending Oct. 31 to $1.26 billion in net sales from $1.31 billion. But events probably won’t affect sales of the game, analysts said. “You sell 80% of your games in the first six weeks,” Mr. Vorhaus said. “For every game they are not selling [due to the controversy], they are selling at least one game due to press attention.”

| ADVERTISING | ||

Videogame Ads Attempt Next Level

By CHRISTOPHER LAWTON

Staff Reporter of THE WALL STREET JOURNAL

July 25, 2005

Advertising in videogames, dominated in the past by static ads such as billboards and signposts, is beginning to look more like TV commercials.

For the past few weeks, Massive Inc., a New York company that distributes ads in videogames, has been testing an ad with full motion and sound in a science-fiction game called Anarchy Online. Today, Massive will roll out the full-motion ad capability to advertisers generally.

![[Massive rolled out a new capability[nbsp ]today that allows advertisers to run full motion ads in[nbsp ]video games.]](http://online.wsj.com/public/resources/images/NA-AF913_Advert07242005205127.jpg) Massive rolled out a new capability that allows advertisers to run full-motion ads in video games. |

Massive’s move comes less than a year after it created a stir in the videogame-advertising industry by offering advertisers the chance to insert still ads into videogames played on Internet-connected computers. Massive uses the Internet to insert ads into spaces in the games. The ads can also be changed and withdrawn whenever the advertisers want. The technique was a big step forward for videogame advertising, which previously was restricted to ads inserted into games while the games were made. Because games can take up to a couple of years to be designed, this required advertisers to put their ads into games well before the games’ release.

The game-insertion technology opened the door for a broader array of marketers to promote their products on videogames. These ads are particularly suitable for Hollywood studios wanting to promote movies a week before their release date or retailers promoting holiday sales, Massive Chief Executive Mitchell Davis says. He says Massive has sold space to 35 advertisers, including Viacom Inc.’s Paramount Pictures.

Finding better ways to advertise in videogames is extremely important for many marketers, particularly those selling products aimed at young men, who often spend more time playing videogames than watching television. To be sure, the money spent on ads in videogames is currently only a drop in the bucket compared with television — $10 million compared with $10 billion on TV advertising aimed at young men, according to estimates from Harris Nesbitt Equity Research. But advertising in videogames is growing fast and expected to reach $92 million by 2008, according to Yankee Group, a global technology-research firm.

“We know the 17 to 34 audience, the male audience, is elusive and quite difficult to reach through traditional broadcast. … It is incumbent upon us to find ways to reach them,” says Gerry Rich, president of world-wide marketing for Paramount Pictures.

The introduction of full-motion ads on games gives advertisers more options. Massive’s Mr. Davis says Hollywood movie studios have shown particular interest in running 15-second movie trailers in online games. Mr. Rich says Paramount may be interested in such ads, but emphasized that the content of any such ads shouldn’t turn off gamers.

To be sure, Massive’s ad-insertion technique has some limits. Massive is so far inserting ads only into computer games connected to the Internet, rather than games played on any of the more popular consoles like Sony Corp.’s PlayStation, Nintendo Co.’s GameCube andMicrosoft Corp.’s Xbox. A little more than a quarter of young men surveyed by Activision Inc. and Nielsen Media Research played videogames online.

Massive says its technology works for both online games and consoles, but it hasn’t yet negotiated a deal allowing for ad-insertion in console games. Mr. Davis says he hopes to strike a console game deal soon. Edward Williams, managing director at Harris Nesbitt Equity Research in New York, says the videogame ads won’t take off until console games are included.

One problem with the full-motion ads is that gamers can easily avoid watching them. The full-motion ads start playing when a player moves near the ad spot on the screen — and stop playing when the player moves away. As a result, gamers may see only a few seconds of the 15-second ads. Massive says it won’t charge advertisers unless the full ad has been viewed.

Write to Christopher Lawton at christopher.lawton@wsj.com

Ads for Sprite, Motley Crue Appear in Anarchy Online

![]()

In-game ads get active

NEW YORK — Short TV-style commercials will make their way into the video game world starting in the summer as in-game advertising provider Massive Inc. plans to debut 10-second spots on its network next month.

“A new medium we have created is a 10-second dynamic ad,” Massive chief marketing officer Nicholas Longano said here Wednesday at a panel about latest trends in the burgeoning in-game ad business. “With it, marketers can test ads and consumer reactions in real time.”

Longano said a traditional 30-second spot would interrupt game play too much, but he is optimistic that gamers will readily watch the shorter commercials. “Advertising makes the gaming experience more realistic … people accept it and actually like it” as long as it doesn’t interfere or distract too much from the game itself, he said.

He explained that players would get to see the short animated videos in “natural” situations, such as when moving their game characters by a TV set that is turned on.

Massive will start using the spots in about two weeks and will charge higher rates than for its static ad displays within games, according to Longano.

He said Massive will provide further details later about the 10-second spots, such as ad partners and games that will use the new tool.

Wednesday’s panel was organized by the Advertising Club and sponsored by Massive, which delivers ads to gamers in real time — on such things as virtual billboards and store fronts — using its video game network.

Gaming industry representatives said at the panel that they will continue to roll out advertising opportunities in their product and they haven’t seen any negative reaction from consumers.

“We use ads where it is authentic,” said Wim Stocks, executive vp at Atari. “So far, we haven’t seen any backlash from consumers.” He predicted that about 30% of Atari games will have ads over the near-term.

However, Stocks predicted that as gamemakers keep pushing the ad envelope to test their limits, “at some point there will be a push-back.” Similar to Hollywood movies, games must over time find the right balance that allows companies to offer ads without alienating consumers.

Industry insiders said Wednesday that film studios are among those that have taken advantage of in-game ad opportunities so far and will be open to experimenting with new forms of commercial messages.

Said Bruce Friend, executive vp and managing director of OTX Research: “The boxoffice has been weak, so studios will look to get more creative in their advertising.”

Stocks said he also expects another form of creativity to become more important in the Hollywood-gaming relationship. Over time, video game developers will likely start working more closely with film studios when it comes to creating games tied to movies, a move that would benefit both sides, he said.

Said Stocks: “If there is more interaction between the film and the game, and the game offers expanded stories and more character development,” gamers will be happier and enjoy both products more.

Courtesy of The Hollywood Reporter

read the story from which this graphic originated

In-game ads may boom in video games:-

SANTA MONICA, Calif. | June 05, 2005

More and more U.S. TV viewers are fast-forwarding through TV commercials and as a result, in-game advertising in video games, may boom.